vermont department of taxes homestead declaration

Use Schedule HI-144 Household Income for the applicable year to amend household income. VERMONT DEPARTMENT OF TAXES ANUARY 2021 4 Statutory Proposals Homestead DeclarationProperty Tax Credit 1.

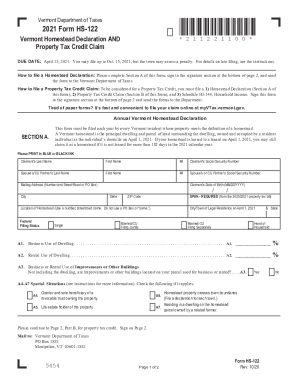

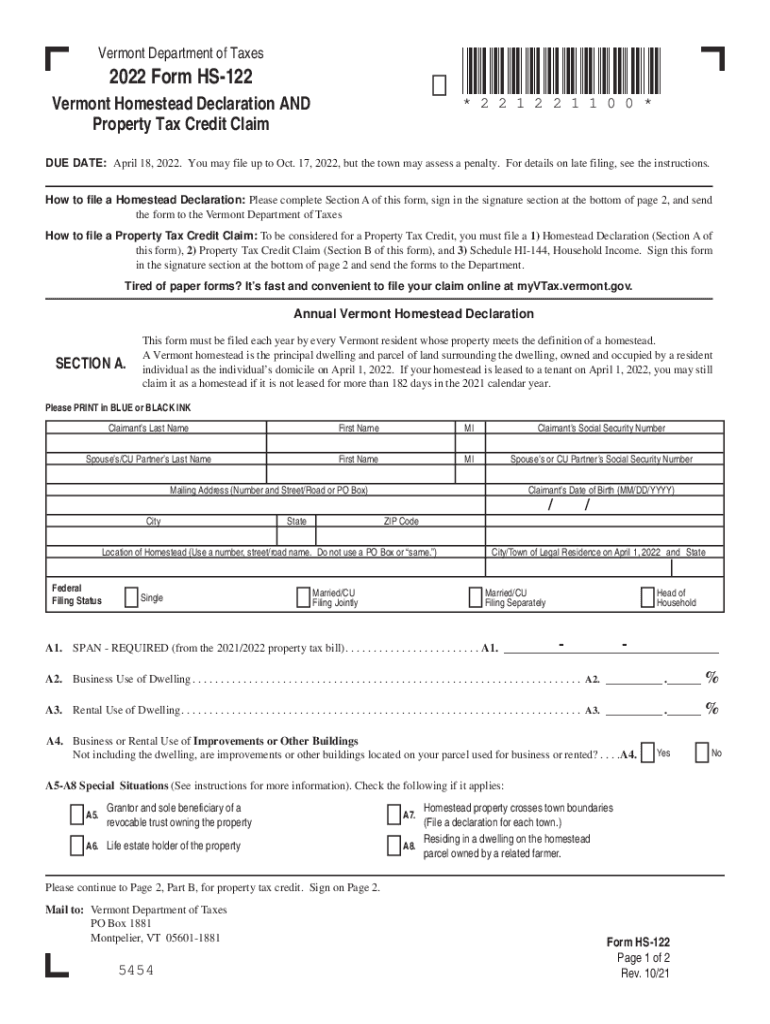

Form HS-122 Homestead Declaration and Property Tax Credit Claim.

. Pay Estimated Income Tax by Voucher. Property owners must have HOMESTEAD DECLARATION on file with the Department of Taxes to be classified as HOMESTEAD and pay a HOMESTEAD rate. Earlier this year the federal and state filing due dates were extended to provide taxpayers additional time.

Send the amended HI-144 separately. Register or Renew a Vehicle Find all of the resources you need to register and renew your vehicle in Vermont. Pay Estimated Income Tax Online.

If your homestead is leased to a tenant on April 1 you may still claim it as a homestead if it is not leased for more than 182 days in the 2020 calendar year. Vermont Department of Labor. The State of Vermont Taxes Property at two different rates HOMESTEAD rate and the non-residential rate.

May 17 Vermont personal income tax and Homestead Declaration due date. The HOMESTEAD DECLARATION Form is Form HS-122. You need to file the following two forms to apply for a property tax credit.

Rental Use of Dwelling. Call 844-545-5640 to schedule an appointment. The state property tax funds education throughout the Green Mountain State and this is the largest portion of your annual property tax bill.

Tax examiners in this division can answer questions about vermont personal income tax homestead declaration property tax adjustment claim and renter rebate claim. To be considered for a Property Tax Credit you must file a 1 Homestead Declaration Section A of this form 2 Property Tax Credit Claim Section B of this form and 3 Schedule HI-144 Household Income. Free Tax Preparation.

Mon 01242022 - 1200. Use myVTax the departments online portal to e-file Form HS-122 Homestead Declaration and Property Tax Adjustment Claim and Schedule HI-144 Household Income with the Department of Taxes. Vermont is a property tax anomaly in that it is one of the few states to levy both county and state property taxes.

You can submit your claim electronically when you file your Vermont Income Tax return. How to file a Homestead Declaration. Pay Estimated Income Tax Online.

The 20212022 property tax bill. Vermont Department of Taxes Issues Refunds to Unemployment Benefit Recipients May 10 2021 May 17 Vermont Personal Income Tax and Homestead Declaration Due Date. Only household income reported on Form HI-144 can be amended or changed.

Property Tax Credit claims have a statutory extended deadline of October 15. Due to the current health situation the due date has been moved from April 15 2020 to July 15 2020. The change or amendment must be done within three years from the April due date.

Please complete Section A of this form sign in the signature section at the bottom of page 2 and send the form to the Vermont Department of Taxes How to file a Property Tax Credit Claim. Each person who owns property and lives on that property mustdeclare homestead this year by April 18th. Business Use of Dwelling.

Locate a Vital Record Search and request certificates of birth. Homestead Declaration Vermont Department of Taxes 2022 Form. IRS Virtual Service Delivery in Montpelier.

All property is considered nonresidential unless it is declared as a homestead. Pay Estimated Income Tax by Voucher. Flyer with options for Free Tax Assistance.

Homestead Declaration and Property Tax Adjustment Filing Vermontgov. Voter Services Register to vote and find other useful information. Vermont Secretary of State.

Vermont Homestead Declaration Form HS-122 Section A The Homestead Declaration must be filed annually by every Vermont resident homeowner on their primary residence as of April 1 of the calendar year. Filing a Homestead Declaration is easy and can be done online at the Vermont. Enter the correct household income and mark AMENDED on the HI-144.

Even if you do not believe you owe property taxes you must declare homestead in order to qualify for Property Tax Adjustment. Pay Estimated Income Tax by Voucher. The Department of Taxes provides this report as required by Act 175 of 2020 Sec.

Your Vermont Homestead Property Tax Exemption Can Bring Big Savings. The form to the Vermont Department of Taxes How to file a Property Tax Credit Claim. Vermont Business Magazine The Vermont Department of Taxes wants to remind Vermonters of the upcoming May 17 2021 due date for federal and Vermont personal income taxes.

Pay Estimated Income Tax Online. Property owners must have a homestead declaration on file with the department of taxes to be. Taxes for Individuals File and pay taxes online and find required forms.

Homestead Declaration Property Tax Adjustment Renter Rebate Landlord Certificate. Use a vermont homestead declaration 2022 template to make your document workflow more streamlined. Property owners whose dwellings meet the definition of a Vermont homestead must file a Homestead Declaration annually by the unextended personal income tax due date April 15.

Tax Year 2021 Instructions HS-122 HI-144 Vermont Homestead Declaration AND Property Tax Credit Claim. If eligible it is important that you file so that you are correctly assessed the homestead tax rate on your property. A reminder to everyone to please file your Homestead Declarations as soon as possible.

If you do not file by this date then you will receive a penalty. Currently pursuant to 32 VSA. The service is by appointment only on Mondays and Wednesdays at the Vermont Department of Taxes 133 State Street Montpelier.

Property Tax Credit Claim. To be considered for a Property Tax Credit you must file a 1 Homestead Declaration Section A of this form 2 Property Tax Credit Claim. On or before February 1 2021 the Department of Taxes in consultation with the Vermont League of Cities and Towns the Vermont Municipal Clerks and Treasurers Association the.

Schedule HI-144 Household Income. All groups and messages. 6068b a taxpayer is not entitled to any Property Tax Credit benefit if a claim is filed after October 15.

VT Department of Taxes is recommending taxpayers to file their HS-122 and HI-44 soon and not delay so tax bills and potential state. The irs provides a comprehensive website with federal forms instructions and more.

50 000 More Vermont Returns Expected By Wednesday Tax Deadline Vtdigger

Vermont Department Of Taxes Youtube

Vermont Hi 144 Form Fill Out And Sign Printable Pdf Template Signnow

File A New Vermont W 4vt Department Of Taxes

Welcome To South Burlington Vermont

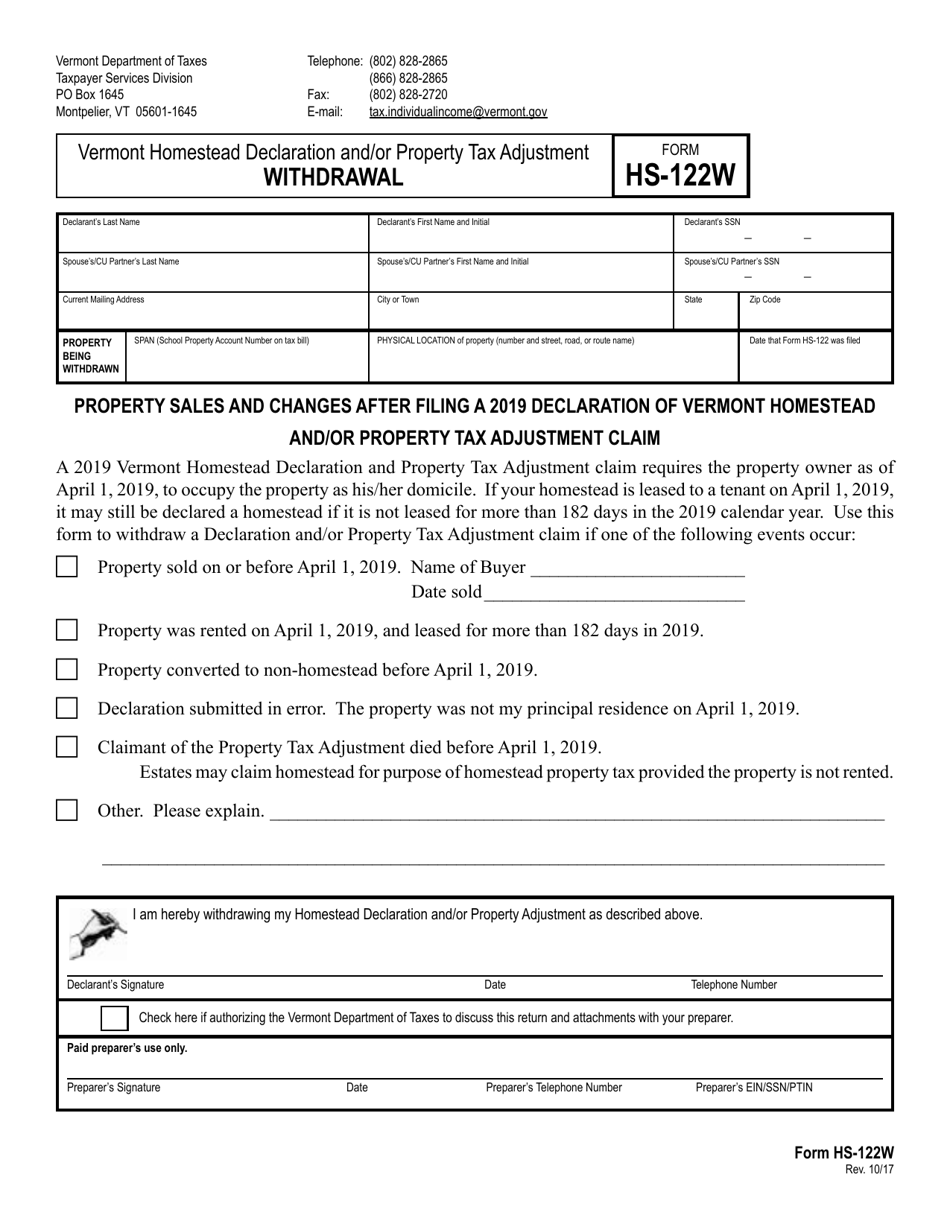

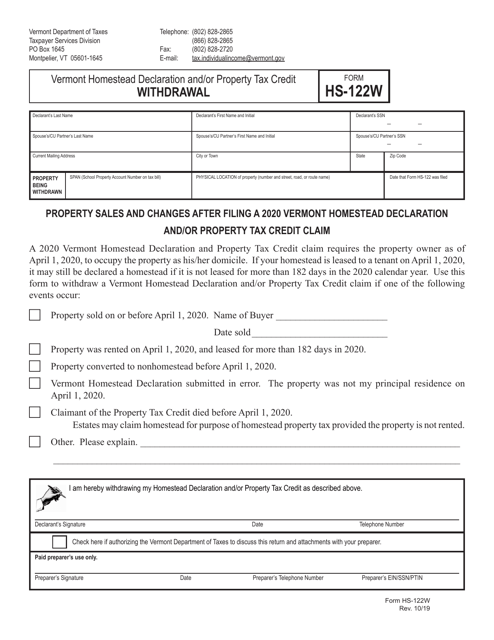

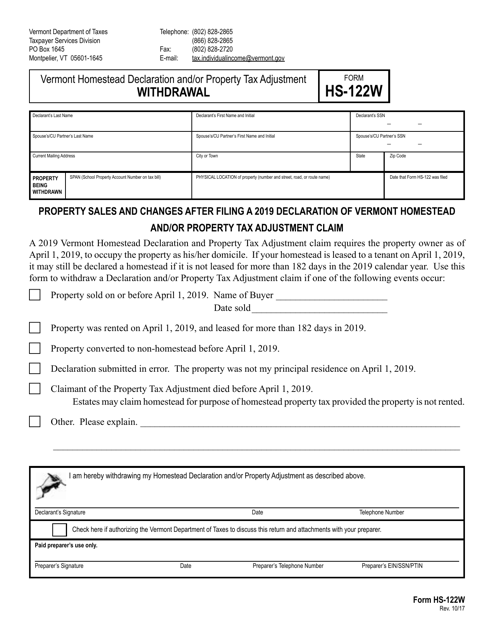

Vt Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Adjustment Withdrawal Vermont Templateroller

Publications Department Of Taxes

Vermont Tax Forms And Instructions For 2021 Form In 111

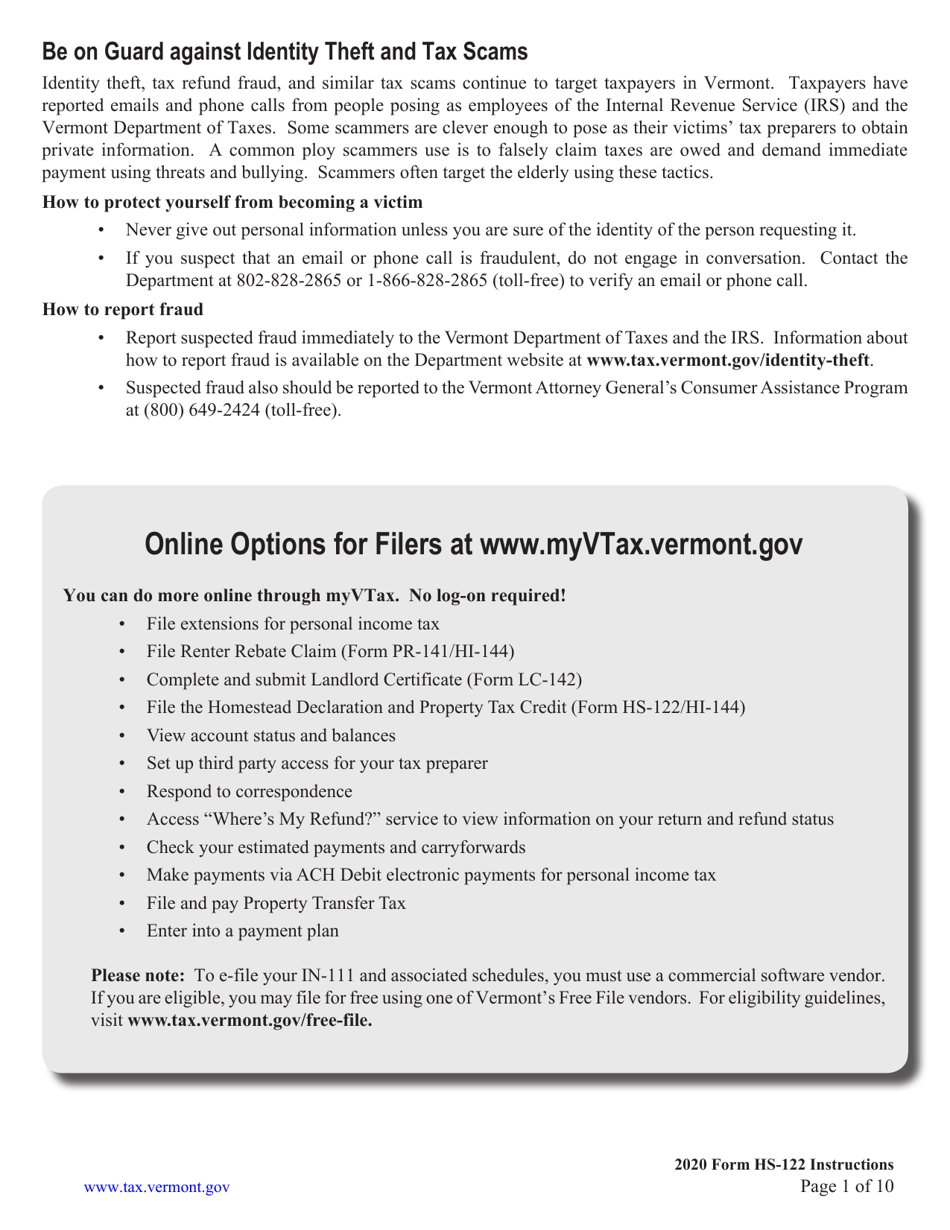

Download Instructions For Form Hs 122 Vermont Homestead Declaration And Property Tax Credit Pdf 2020 Templateroller

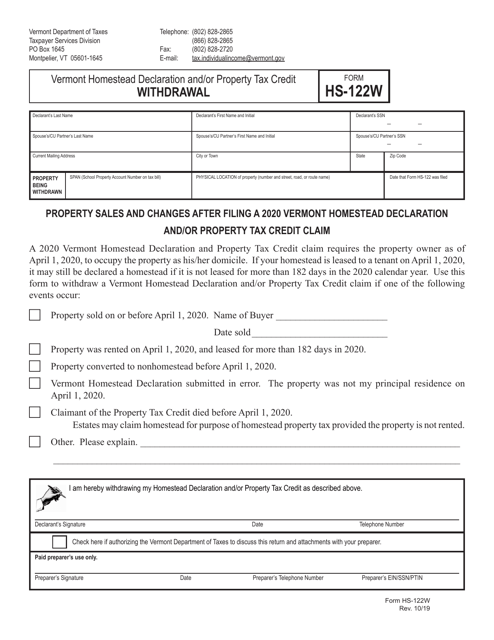

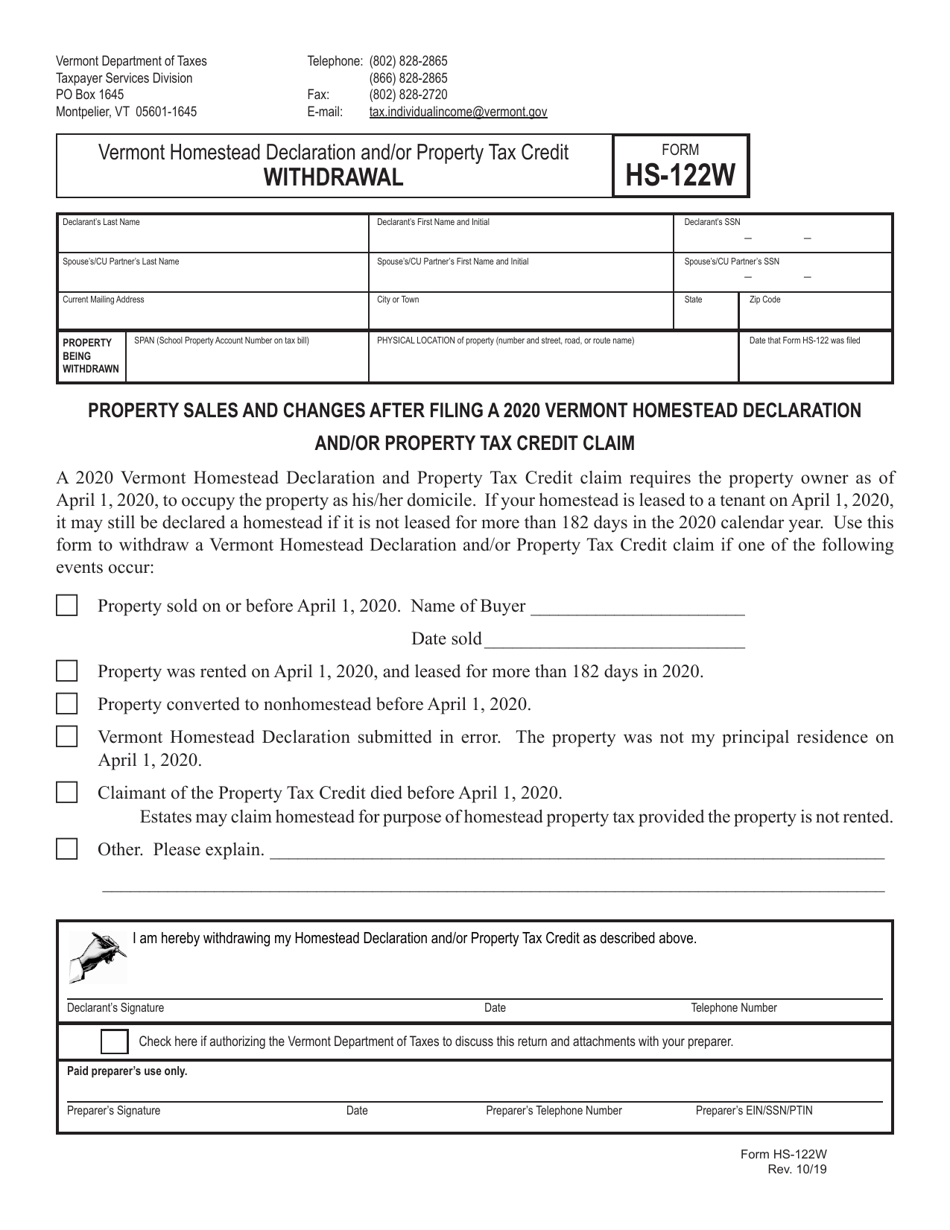

Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Credit Withdrawal 2020 Vermont Templateroller

2022 Vt Form Hs 122 Fill Online Printable Fillable Blank Pdffiller

Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Credit Withdrawal 2020 Vermont Templateroller

Vt Form Hs 122w Download Printable Pdf Or Fill Online Vermont Homestead Declaration And Or Property Tax Adjustment Withdrawal Vermont Templateroller

Reminder U S And Vermont Income Taxes Must Be Filed By May 17